Semi-Supervised Classification on Credit Card Fraud Detection using AutoEncoders

Abstract

The use of credit cards for online purchases has increased dramatically and led to an explosion in credit card fraud. Credit card companies need to be able to identify fraudulent credit card transactions so that customers are not charged for items they do not buy. In this study, we will use semi-supervised learning and combine it with AutoEncoders to identify fraudulent credit card transactions. In this paper, we will implement the use of T-SNE to visualize fraud and non-fraud transactions, then improve the visualization using autoencoders. Classification report proved that it is possible to achieve very acceptable precision using semi-supervised classification to detect credit card fraud.

Article Metrics

Abstract: 1130 Viewers PDF: 684 ViewersKeywords

Data Science; Semi-Supervised Classification; Credit Card Fraud; AutoEncoders

Full Text:

PDF

DOI:

https://doi.org/10.47738/jads.v2i1.16

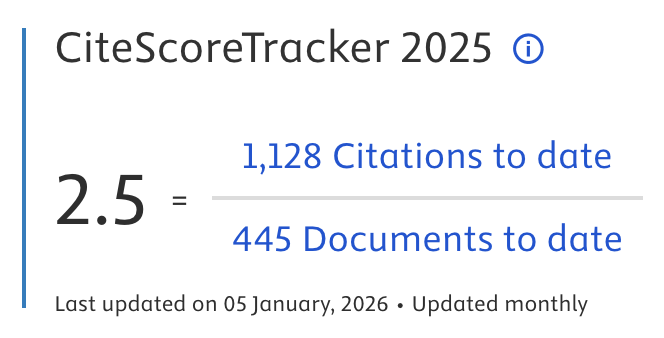

Citation Analysis:

Refbacks

- There are currently no refbacks.

Journal of Applied Data Sciences

| ISSN | : | 2723-6471 (Online) |

| Collaborated with | : | Computer Science and Systems Information Technology, King Abdulaziz University, Kingdom of Saudi Arabia. |

| Publisher | : | Bright Publisher |

| Website | : | http://bright-journal.org/JADS |

| : | taqwa@amikompurwokerto.ac.id (principal contact) | |

| support@bright-journal.org (technical issues) |

This work is licensed under a Creative Commons Attribution-ShareAlike 4.0

This work is licensed under a Creative Commons Attribution-ShareAlike 4.0

.png)