Bank Soundness Level Prediction: ANFIS vs Deep Learning

Abstract

The systemic nature of the risk of bankruptcy of financial institutions has become an important issue in maintaining the existence and stability of domestic and global finance. The use of statistics for bankruptcy prediction so far provides optimal benefits. However, this approach has limitations, especially since the model is built based on systematic relationships, so the linearity and normality aspects are often weaknesses. This can be overcome very efficiently through linear and non-linear patterns built by artificial intelligence models. One of the most popular of these techniques is the Artificial Neural Network (ANN). Many studies show that ANN and fuzzy set theory is more accurate, adaptive, and strong in predicting compared to statistical models. One technique to integrate ANN with fuzzy logic systems is through the Adaptive-Network-Based Fuzzy Inference System (ANFIS). ANFIS is an adaptive network that is functionally equivalent to fuzzy inference and has the advantages of ANN and fuzzy logic. One of the important features of ANFIS is its acclimatization capability where the membership function parameters can adapt and change in the learning procedure. Utilizing the ANN model and fuzzy logic for bankruptcy prediction is still very limited in Indonesia. Therefore, this study aims to construct a financial institution bankruptcy prediction model that is much more accurate, operational quickly, and effective through ANFIS as a hybrid of fuzzy logic and ANN. The results showed that ANFIS can be used to predict the bankruptcy of financial institutions with the best MAPE 0.140335507.

Article Metrics

Abstract: 582 Viewers PDF: 388 ViewersKeywords

Prediction; ANFIS; Deep Learning; Bank Soundness Level

Full Text:

PDF

DOI:

https://doi.org/10.47738/jads.v4i3.116

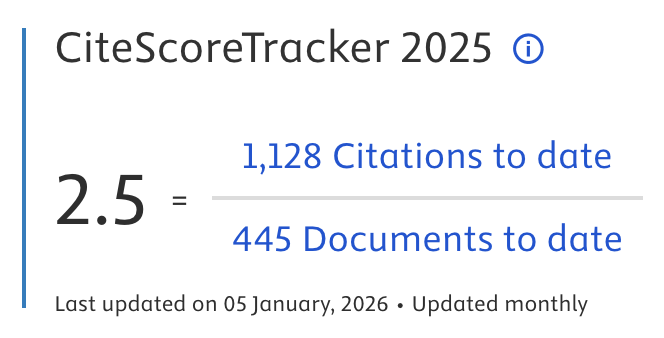

Citation Analysis:

Refbacks

- There are currently no refbacks.

Journal of Applied Data Sciences

| ISSN | : | 2723-6471 (Online) |

| Collaborated with | : | Computer Science and Systems Information Technology, King Abdulaziz University, Kingdom of Saudi Arabia. |

| Publisher | : | Bright Publisher |

| Website | : | http://bright-journal.org/JADS |

| : | taqwa@amikompurwokerto.ac.id (principal contact) | |

| support@bright-journal.org (technical issues) |

This work is licensed under a Creative Commons Attribution-ShareAlike 4.0

This work is licensed under a Creative Commons Attribution-ShareAlike 4.0

.png)