Applied Data Science for Exploring Multi-Channel Retail Service Quality Affecting Customer Satisfaction and Loyalty at Commercial Banks

Abstract

This study examines how service quality across physical and digital channels influences customer satisfaction and loyalty within the omnichannel environment of commercial banks in Vietnam. Although digital transformation has accelerated rapidly, there remains limited empirical evidence on how integrating traditional service encounters with online and mobile platforms shapes customer perceptions and behavioral intentions. Addressing this gap, the paper develops and tests a comprehensive model that integrates traditional service quality dimensions, digital platform quality, and multi-channel integration, while also considering the moderating role of customers’ digital competence. The study contributes to the literature by extending conventional service quality frameworks to encompass the realities of omnichannel banking in an emerging market. It highlights the relative importance of physical facilities, staff professionalism, digital platform usability, and cross-channel consistency in shaping customer experiences. A two-phase methodology was employed. The qualitative phase involved expert evaluations and customer focus groups to refine measurement items and ensure contextual relevance. The quantitative phase gathered data from 785 retail banking customers and analyzed the relationships among the constructs using variance-based structural modeling. Findings indicate that all dimensions of service quality positively influence satisfaction, with physical facilities and multi-channel integration emerging as the strongest drivers. Satisfaction significantly enhances loyalty and mediates the effects of service quality dimensions. Digital competence both directly strengthens loyalty and moderates the satisfaction–loyalty relationship, suggesting that customers with higher digital skills derive more value from omnichannel services and are more likely to remain loyal. The study underscores the need for banks to invest in both modern physical infrastructures and high-performing digital platforms, while ensuring seamless integration across channels. It also emphasizes the importance of designing differentiated strategies tailored to customers’ digital capabilities to enhance overall satisfaction and foster long-term loyalty.

Article Metrics

Abstract: 213 Viewers PDF: 160 ViewersKeywords

Full Text:

PDFRefbacks

- There are currently no refbacks.

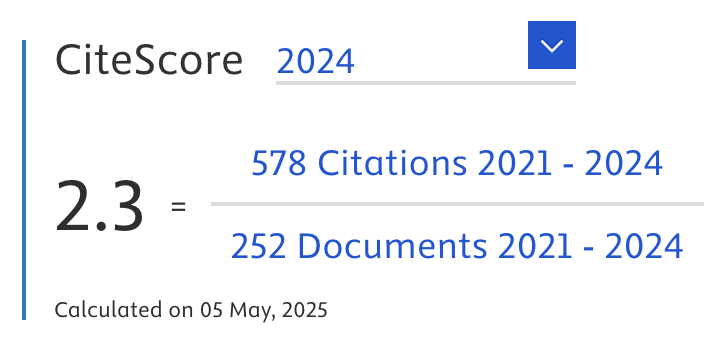

Journal of Applied Data Sciences

| ISSN | : | 2723-6471 (Online) |

| Collaborated with | : | Computer Science and Systems Information Technology, King Abdulaziz University, Kingdom of Saudi Arabia. |

| Publisher | : | Bright Publisher |

| Website | : | http://bright-journal.org/JADS |

| : | taqwa@amikompurwokerto.ac.id (principal contact) | |

| support@bright-journal.org (technical issues) |

This work is licensed under a Creative Commons Attribution-ShareAlike 4.0

This work is licensed under a Creative Commons Attribution-ShareAlike 4.0

.png)